Getting success in today’s modern age depends on the quality of education and enrolling in an excellent college. Great colleges cost more, and to pay the fees, students need to rely on education loans. With the Greatlakes login offered by MyGreatLakes, students can easily manage their loan profile online. MyGreatLakes, or “Great Lakes,” offers student loans to borrowers for their education and career.

To access the MyGreatLakes Login student loan account online, the student loan borrowers need to open the www.greatlakesstudentloan.com login or mygreatlakes.org login websites. Using their Great Lakes login credentials like username and password, they can easily see all the details about their borrowed loan.

MyGreatLakes Introduction

Great Lakes Student Loans, or MyGreatLakes, is one of the best student loan providers in the US that offers financial services to students for pursuing studies and building a career. It provides easy access and loan management service by offering easy Greatlakes login to the students. With Great Lakes login, students can check the due amount, installment details, and other details online on any device.

MyGreatLakes understands the importance of getting higher education, building a career, and achieving success. It has successfully helped millions of students achieve their set goals and make their dreams a reality through student loans. For students facing difficulties pursuing their careers due to financial stretch, MyGreatLakes can be an ideal option for getting much-needed financial support.

Great Lakes serves as an intermediary authority that connects students with loan providers. However, it provides all the information the borrowers need about their loans with its Great Lakes loans login portal.

Some people may assume that the financial services provided by the www.greatlakesstudentloan.com login or mygreatlakes.org login portals are not trusted and may be fraud. But Great Lakes Student Loans are among the most authentic student loan managers in the United States that help students get financial support for their careers.

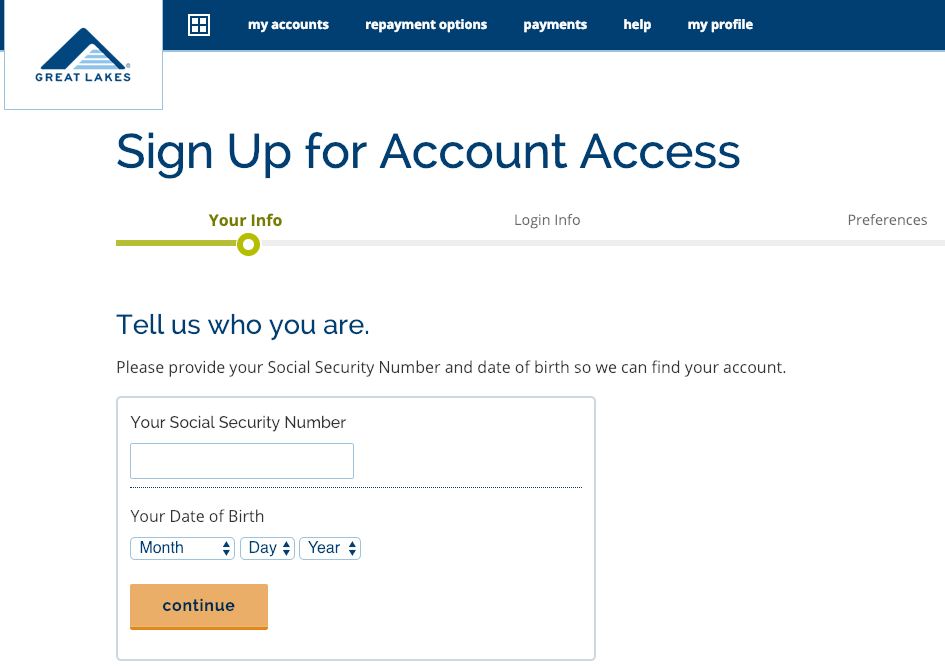

MyGreatLakes Registration Procedure

If you wish to sign up for the Great Lakes Student Loans login portal to create your new account, you will have to visit the official portal or follow the steps mentioned below.

- Open the official My Great Lakes Student Loan portal by clicking this link – www.greatlakesstudentloan.com

- After the Great Lakes Login portal opens, please find the “Register” option, mostly available in the top right order.

- Now, keep your personal details ready to submit to the portal, along with your social security number and birth date.

- Click the “Next” button once you add all the requested details in the blanks on the registration page.

- Now, you must create your unique username and password to log in to the portal in the future.

- Clicking on the “Submit” button will finish the entire process. Please make sure that you add only the correct details in the blanks.

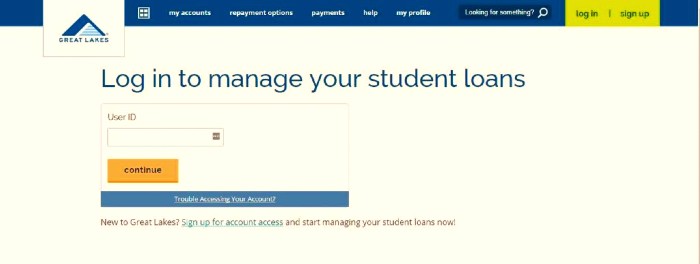

MyGreatLakes Login Procedure

After you register to the Great Lakes portal and generate your new GreatLakes login credentials, the next step is to use them to access your account. Check these steps to access your Mygreatlakes login account to avoid any mistakes.

- To open your account using Mygreatlakes login, please visit the official Great Lake portal at www.greatlakes.com.

- On the website, there will be options like “Great Lakes sign in” or “Great Lakes log in”.

- After clicking that option, you have to provide your username and password. Simply click login to complete the process.

- Once you access your GreatLakes Login account, you will be able to see your personalized dashboard with the loan’s details.

Why Great Lakes?

Great Lakes Higher Education Corporation has been one of the most preferred loan services for a long time. It has made a good impression on millions of borrowers, including students and their parents or guardians. With such a good loan history, it is safe to say that Great Lakes offers one of the best student loan service providers and guarantors in the United States. Great Lakes’s former arm,

Great Lakes Education Loan Services guaranteed over $51 billion in loans under The Federal Family Education Loan (FFEL) Program. It now works with 6,000 schools in the country, along with 10,000,000 borrowers and 1,100 lenders. Also, the company sometimes gives grants related to education to focus on increasing access to higher education. With over 2,000 employees working at My Great Lakes, the corporation has been in the top position in the student loan market in the US.

The fundamental thing the firm does is to provide student financial aid during their challenging times. Many students have achieved great success for years by paying their college fees and pursuing their dream subjects. The platform launched easy payment methods for students so that they can repay their borrowed loans. All of these, combined with the MyGreatLakes portal, have made it easy for students to access the loan details easily using their devices. All they need is valid Great Lakes login details, including username and password.

Many people in the United States have questions about the Great Lakes Student Loan login services. Some people even assume it is a fraud corporation and that lending student loans is a scam. But many benefactors and the people who know about it think it is the best company in the market that provides the best student loans. Besides this, millions of students have already registered and benefitted from the MyGreatLakes company. They could also repay their borrowed loan on time without facing any problems.

People questioning the corporation should realize it is a finance and education company in the United States and backed by the federal government. Moreover, the company also has affiliations with federal loans and offers convenient ways for students to repay them. The repayment plans offered by the corporation are moderate and offer flexibility to the borrowers to pay on time and fulfill their dream qualifications. Therefore, they should ignore the rumors and whispers about the integrity of MyGreatLakes student loans.

Over a million satisfied customers have given positive feedback and reviews about the services offered by My Great Lakes. A client has said that he was concerned about taking student loans and how to manage them, but the corporation helped him. Another person said that he was not aware of the student loans and whether they worked or not, but MyGreatLakes helped him easily manage his loan and his graduation. With such a high number of positive reviews and feedback, the Great Lakes has become one of the most trusted loan providers in the United States of America.

In a nutshell, the company stands out in the following criteria,

- Excellent customer services

- Online simple-to-understand and easy-to-operate user interface

- Affiliations with lenders

- Comprehensive loan management system

- Educational resources and staff members

- Moderate repayment plans

Great Lakes Benefits

MyGreatLakes may be unable to provide student loans at lower interest, but it provides other benefits. If you want a loan at lower rates than the Great Lakes services, you can search for other refinancing options with other lenders. In the market, there are many companies that provide refinancing services and student loans. In 2023, the best refinancing rates start from 2.5%. You can also reduce the overall cost of the loan by locking lower interest rates that will clip off the repayment period. By choosing these options, you can easily get better options to manage your loans than MyGreatLakes with a new agreement that States new loan terms.

Online Payment Convenience:

Great Lakes offers convenient ways to repay the borrowed student loans easily. The corporation offers convenience to the users by allowing them to access the Great Lakes borrowing service login to manage the loans. The loan management portal is accessible using any device like a personal computer, laptop, or smartphone. The service provider also offers mobile applications that make the login process very easy.

Loan Repayment Options:

Great Lakes offers moderate payment plans and the ability to choose the amount that suits the repayment requirements. With available plans, the borrowers have the flexibility to choose the best option according to their repaying terms.

Latest Updates:

You can regularly get the latest updates and reminders related to the payment confirmation. You can use your My Great Lakes Sign In credentials to access your account and check the details about your payment status, loan interest, loan details, and credit details. At regular intervals, you can get all the details related to the payment process of your student loan.

Safety and security:

After you create your new Great Lakes account, you can securely access your account using mygreatlakes.org login credentials. The Mygreatlakes Student Loans portal offers encrypted service to its users and a secure identity verification process. They allow the safety and security of your student loan information.

Great Lakes Salient Features

MyGreatLakes is popular for providing one of the best customer services to student loan borrowers. The corporation offers the customers the cheapest payment options, which ultimately leads to better financial management. The portal helps the students manage all their transactions and keep track of their loans until they are successful.

Here is the list of salient features offered by Great Lakes:

- Access the online account and get details about the monthly statement and pay bills online

- The portal allows customers to make automatic payments. With this option, the customer can have automatic payment directions from their respective banks, and the interest rate of the loan will drop by 0.25%.

- MyGreatLakes also helps you avoid late payment penalties by temporarily delaying your payment or even decreasing their values if you meet the required criteria. But, you have to be careful as the interest rates can go up anytime according to the terms and conditions.

- Other benefits of using the MyGreatLakes portal include making additional payments for which you will have to request the corporation using your current balance. The firm also allows you to make payments with interest the following month. You can contact them via online methods, by mail, or over the phone. My Great Lakes also allows you to keep track of all your payments so that you can never get lost in the details.

Great Lakes Terminologies

The students borrowing loans from MyGreatLakes must understand different Great Lakes terminologies before moving ahead with the decision. Great Lakes offers limited but ample payment options for the borrowers and charges the amount associated with the services. Therefore, before adopting any Greatlakes login financial services, you need to ensure that it satisfies your needs.

If you are clear with the MyGreatLakes terminologies, you can make the most of the services offered by the firm. Please familiarize yourself with key terminologies:

- Student Loan: It is a loan borrowed by students to fund their higher education expenses, including accommodation costs, books, tuition fees, and more.

- Refinancing and consolidation: Consolidation and refinance are very different terms but often mixed by people as one. According to one understanding, Refinancing combines two different loan types into a single one, like federal and private loans. On the other hand, consolidating combines the federal loan into a completely new loan amount.

- Principal amount: The basic loan amount the lender grants is popularly called the “principal amount”. It is the same amount that the borrower will receive.

- Federal consolidation: You will get the federal consolidation services with all federal loans, as MyGreatLakes does not provide it directly.

- Interest rate: The money you pay to the lender for borrowing the principal amount is the “Interest rate”. Interest may vary based on your selected loan type and with different lenders.

- Loan Guarantor: A loan guarantor is usually a person who takes responsibility to repay the borrower’s debt if he fails to repay it.

Payment Methods

MyGreatLakes provides “individual payment reference numbers” to borrowers instead of account numbers. So, if you borrow a loan from this firm, you will get a 15-digit code that will serve as your payment reference number stamped on the Great Lakes account statement.

The best way to make online payments is by using the www.greatlakesstudentloan.com login or mygreatlakes.org login portals. Great Lakes offers two popular methods to make payment:

1) automatic payment, and 2) one-time payment.

By using automatic payment, you can easily enable auto deduction for your borrowed loan directly from your account. If you go with this option, you can get up to a 25% reduction in your interest rates.

Besides these payment options, this platform helps borrowers to pay using a money order, check, and other online methods.

Customer Support

GreatLakes or My Great Lakes Higher Education Corporation has the best customer support and helps quickly resolve any issues you face. If you are facing issues or have questions, the MyGreatLakes customer support team will help solve them through the following method. Please check the Great Lakes Contact Details below,

- Official website: www.mygreatlakes.org

- Customer Service Number: 800-236-4300

- Great Lakes Loan Repayment Address:

PO Box 530229

Atlanta, GA 30353-0229

(Great Lakes Department of Education processes and manages ED’s loans)

- Alternative Mailing Address:

Box PO Great Lakes 3059

Milwaukee, WI 53201-3059

- General Correspondence Address:

Great Lakes

PO Box 7860

Madison, WI 53707-7860

- Hours of operations: Monday to Friday, 7 a.m. to 9 p.m. CT

Besides these options, you can also reach out to the customer support team via online chat support, which is available on the MyGreatLakes Login home page.

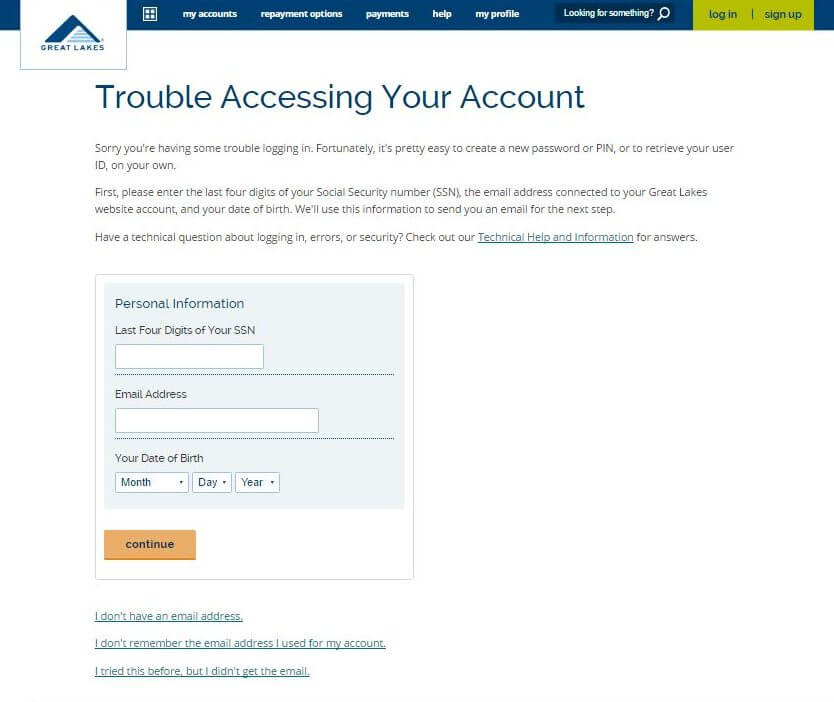

Troubleshooting

Some of you may be facing problems you cannot resolve using contact details or have some specific query related to MyGreatLakes. In such a situation, you can directly reach the system administrator using the official email, contact number, or social media accounts.

- By asking for help from Great Lakes on Facebook, you will increase your chances of getting a reply within a short time, likely less than a few hours.

- If you want a budget-friendly repayment option, you can also use the company’s knowledge Centre and choose the option of a payment planner. By taking help from the knowledge center, you can also get the answers to the most common questions that you may have.

According to a study, My Great Lakes has not received any major complaints from the Consumer Financial Protection Bureau (CFPB) compared to any other credit management firm. Between March 2017 and March 2018, the company received only 310 complaints compared to others having more than 3500 complaints. However, according to a study, people complained to the administrator about the following 2 major issues related to the MyGreatLakes portal.

- Issues related to payment processing: The most common issues faced by the borrowers with MyGreatLakes are related to payment. The Complaints about allocating the payment wrongly and giving completely wrong notification of late payments. Besides these, people also complain about many other payment-related issues. However, the Consumer Financial Protection Bureau said that the company resolved all the issues promptly without any problems. Still, while working with administrators, it becomes very important to keep track of all the payments made every month, as well as make automatic payments.

- Wrong information about the loans: Besides payment processing, borrowers complain about the portal providing wrong information about their loans. If you have such an issue while checking any details about your loan, please contact the administrator quickly and get a quick solution.

FAQs

What is Mygreatlakes Login?

@MyGreatLakes I never received the email about how to login

— Chiffon (@mzsexy24) January 23, 2014

MyGreatLakes login portal helps students to manage their loans online. With the help of this online student loan portal, borrowers can easily check their status, repay their loans on time, clear their dues, and avoid high penalties.

What happened to MyGreatLakes Student Loans?

Great Lakes no longer manages federal student loans and has moved them to Nelnet as authorized by the US Department of Education. You can find more details about this transfer at StudentAid.gov/greatlakes.

Is Great Lakes loans login secure?

Yes, the My Great Lakes login portal is one of the most secure portals where you can access all the details about your student loan.

Does Great Lakes help me reduce my interest rate?

Using My Great Lakes portal’s automatic payment option, you can significantly reduce the interest rate to 0.25%. This option allows you to pay directly from your respective bank.

Is it possible to change my repayment plan?

MyGreatLakes offers a range of moderate payment plans from which to choose. You can explore these repayment plans on the official My Great Lakes login portal and make the necessary changes.

I am Marry Soni. Since 2015, I’ve been a blogger, and I adore writing. I greatly enjoy writing about survey and login guide. I maintain numerous blogs, including https://takesurvery.com/. pdpanchal@gmail.com is how you may get in touch with me.

![Discover Student Loans Login to Create & Manage Your Loan Account [2024] discover student loans login](https://mytakesurvery.b-cdn.net/wp-content/uploads/2023/02/discover-student-loans-login-150x150.png)

![MyFedLoan Login to Access FedLoan Servicing Portal [2024] myfedloan login](https://mytakesurvery.b-cdn.net/wp-content/uploads/2023/06/myfedloan-login-150x150.png)